Governor Gavin Newsom of California issued an executive order on March 30, 2020, that allows businesses who are impacted by the COVID-19 pandemic, and are required to file a sales and use tax return, to obtain an extension on filing and paying their California sales and use tax return. The intention is to provide businesses with relief of penalties and interest that would have applied due to late filing or late payment of the tax.

Governor Gavin Newsom of California issued an executive order on March 30, 2020, that allows businesses who are impacted by the COVID-19 pandemic, and are required to file a sales and use tax return, to obtain an extension on filing and paying their California sales and use tax return. The intention is to provide businesses with relief of penalties and interest that would have applied due to late filing or late payment of the tax.

It’s important to note that the California Department of Tax and Fee Administration (CDTFA) isn’t waiving payment of the tax. Businesses still have an obligation to remit tax even though the obligation can now be temporarily deferred.

Specific provisions are detailed below.

Extension Dates

Less Than $1 Million

For businesses that have tax liabilities of less than $1 million in tax, business tax returns that were due between April 1, 2020, and July 31, 2020, have been extended three months from the due date. Extension is automatic for those that qualify; no penalties or interest will apply.

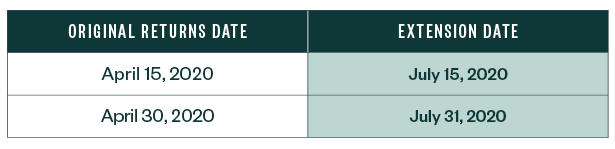

Some of the changed dates are reflected in the following table:

Quarterly prepayments also qualify for the extension.

Greater Than $1 Million

For businesses that have a tax liability of $1 million or more, an extension may be requested through the taxpayer’s online services account. These extensions will be considered on a case-by-case basis and the taxpayer will be notified if their extension has been approved or denied.

Less Than $5 Million in Annual Sales

Interest free payment plans, the following rules apply:

- $50,000 in sales and use tax payments can be spread out over a 12-month period.

- Payments begin July 31, 2020.

- Deferment only applies to sales and use tax.

Payment plans must be requested via CDTFA Online Services.

Considerations

Businesses should be aware of the following:

- Applicable tax returns

- Updated due dates

Payment of the sales and use tax needs to be completed by the end of the extension in full unless the deferred payment plan is entered into with the CDTFA.

Failure to file the return or make the payment of sales and use tax in full at that time will subject the business to interest and penalties.

Businesses should also be mindful of using tax collected from their customers for interim operating cash flow needs; those monies are trust fund taxes and must ultimately be paid to the state pursuant to the deferral.

We’re Here to Help

If you have any questions regarding the extension dates, please contact your Moss Adams professional.